Expats with an entrepreneurial mindset might be keen to start a business in Germany. And that’s a great idea – this country is Europe’s biggest economy and in a great location. Anyone living in Germany can set up a business, but once the excitement of the launch has worn off, it’s time to think about the everyday finances and paperwork.

When you run a business in Germany, you need to consider several financial matters. For example, you will probably need to open a bank account, take out business insurance, and determine which taxes apply to your company. Read on to find out how to organize all of your business admin, with sections on:

- Your business administation in Germany

- Starting a business in Germany

- Business banking in Germany

- German business insurance

- Business accounting in Germany

- Making an invoice in Germany

- Taxation for businesses in Germany

- Hiring staff in Germany

- Social security considerations for freelancers in Germany

- Useful resources

Regus Global

Looking for a great location to work on your business? Regus is a global network of workspaces. Providing private office space, co-working places, virtual offices, and meeting rooms, their professional workspaces allow you to get business done in a productive environment. Join the Regus global community and find the perfect place to work.

Your business administation in Germany

It’s essential to keep your records up to date when running a German business. All businesses in the country have to retain accounting records for ten years. Corporations need to use double-entry bookkeeping, while others can keep simplified accounts. No matter the size of your business, keeping accurate records will give you a clearer idea of your income, expenses, and the tax you need to pay.

Starting a business in Germany

In theory, anyone in Germany can set up a business. If you’re from the EU or EFTA, you may start a business without meeting any residency requirements. However, you’ll need a German residency permit and potentially a visa for self-employment if you come from other countries. Make sure your business plan meets the financial requirements before setting up your company.

You’ll also need to decide what type of company to set up. In Germany, there are several different forms that your business can take, which fall into three main categories. For example, you might run a sole proprietorship (Einzelunternehmen) as a freelancer (Frieberufler), self-employed tradesperson, or businessperson (Gewerbetreibender). When there are two or more owners, you can set up a general partnership (Gesellschaft bürgerlichen Recht – GbR) or a limited partnership (Kommanditgesellschaft – KG). Finally, there are several types of corporations in Germany. These are separate legal entities from their owners.

Business banking in Germany

When it comes to business banking in Germany, sole traders and unincorporated partnerships don’t need to open a separate business bank account. Still, it makes keeping a record of business profits and spending more manageable. However, if you set up a corporation in Germany, you must have a business bank account.

To open a business account as a corporation, you’ll need the ID of business owners, articles of association, a list of shareholders, and a registration certificate. You’ll also need to provide a trade license or permit in some industries. You can also open an account with an international or mobile online bank that offers business accounts, such as:

These have many advantages, such as an English-language app. Don’t forget to check our Business Directory for more banks in Germany. You can also compare deals on DeutschesKonto.

German business insurance

There are several different types of business-related insurance in Germany. Naturally, different ones will apply to you, depending on your business activities and the structure of your company. Indeed, some types of insurance are compulsory for certain types of companies. If you’re not sure which applies to your company, check with an insurance broker to make sure you’re covered.

Bear in mind that every resident in Germany requires health insurance, which you can find out about further down the page.

Liability insurance

In Germany, there are several types of liability insurance (Haftpflichtversicherung). It’s a good idea for everyone living in the country to take out personal liability insurance, which covers you for injuries and damages caused by third parties. However, if you run a business, you will need other liability insurance to cover issues arising from your work. These might include:

- Professional liability insurance (Berufshaftpflichtversicherung) – some professionals, such as architects, engineers, and medics require this insurance, while it is optional for others. It covers employees and others working for your company, and sometimes covers external subcontractors. This type of insurance protects you from claims of negligence, clients’ dissatisfaction or financial loss, and copyright infringements among others. Companies such as helden.de offer this type of coverage.

- Cyber liability insurance (Cyberversicherung) – with many businesses operating online or relying on online platforms, this can be a life-saver. Cyber liability insurance is optional coverage that protects you in case of hacking, phishing, or malware.

- Product liability insurance (Produkthaftpflichtversicherung) – if you make or sell products, this protects you in case of defects.

- Environmental liability insurance (Umwelthaftpflichtversicherung) – this insurance is required for companies in chemical, construction, and mechanical engineering industries.

Property and contents insurance

If your business has operating equipment or property, you must take out contents insurance (Inhaltsversicherung). This covers the costs in case of damage caused by natural hazards, fire, malicious damage, and more. It’s also possible to get loss of earnings insurance (Ertragsausfallversicherung) to cover the costs of wages during closure due to one of these events.

Business accounting in Germany

Corporations in Germany must use double-entry bookkeeping, while other businesses can use simplified accounts. You will need to undertake an external audit if at least two of the following characteristics apply to your business:

- Balance sheet total of €6 million or more

- Annual turnover of €12 million or more

- 50 or more employees as an average over the course of a year

No matter how small the business you run in Germany, you should keep a record of your earnings and copies of your invoices. This will make filing your taxes much more straightforward, and means you’ll be prepared if you need to provide proof of earnings.

You should also keep an account of your expenses, as certain items are deductible from your tax return. You should keep financial records, including statements and invoices, for at least ten years, while commercial and business letters should be retained for six years. There are many accounting software programs to help you keep business records and assist you in your tax returns. These include:

- Buchhaltungsbutler

- Taxback – for income tax refunds

- Taxfix

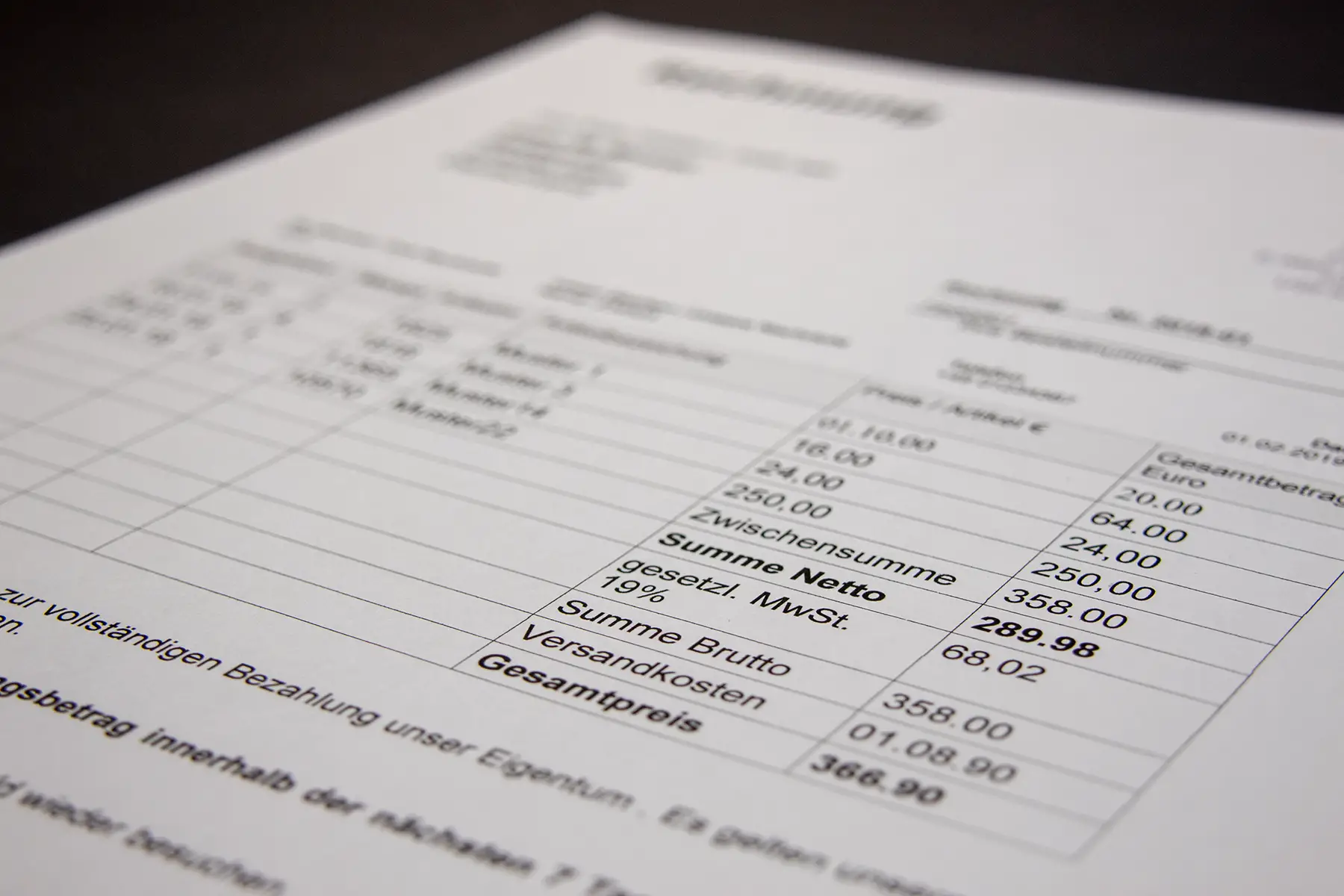

Making an invoice in Germany

Freelancers and companies must send invoices for products and services. When your company issues an invoice to a client inside Germany, it must include:

- Company name and address

- An invoice number

- Date of issue

- Company tax or VAT number

- Type and amount of goods/services provided

- The date the goods or service was supplied

- Amount owed as a gross figure, plus details of VAT amount/rate if applicable (if not applicable, you should indicate why)

- The name of the recipient

- Payment details such as your business bank account number

When you invoice a client in another EU country, you don’t charge VAT. However, you will need to indicate your client’s VAT number so that they can pay tax on your services in their own country. For clients outside the EU, you need to determine whether their country has a tax agreement with Germany. If you’re unsure, contact a tax advisor.

What to do if a customer does not pay your invoice

It’s every freelancer’s worst nightmare, yet it happens to everyone – what do you do when someone doesn’t pay you on time? Firstly, it’s good to indicate a due date at the bottom of your invoice (such as “payment due within two weeks of receipt”). If the client has not paid, you can try sending them a reminder – you are not obligated to do so, but it’s more diplomatic than immediate escalation. Furthermore, it could be that the client has simply forgotten, and sends you the payment immediately.

As a last resort, when a customer has not paid, you should send a Mahnung. This is a written notice which should include a copy of your invoice and give a set deadline. Following this, you can send a second and third Mahnung and charge late fees if you wish. Finally, should the invoice remain unpaid, consider whether you want to take the client to court. You can do this by announcing a legal dunning procedure (Gerichtliches Mahnverfahren), which you can do online.

Taxation for businesses in Germany

When you run a business in Germany, you should take into account the following taxes:

- Corporate tax (Körperschaftsteuer) – all incorporated businesses pay this every quarter. The current rate is 15% of profits, plus a solidarity surcharge of 5% (making the actual rate 15.825%). Owners of sole proprietorships and partnerships pay income tax on their individual profit share instead.

- VAT (Umsatzsteuer) – payable if you sell goods and services and have an annual turnover of over €22,000. The full rate is 19% of turnover, although some professions pay a reduced rate of 7%. You can claim back VAT by charging it to customers.

- Trade Tax (Gewerbesteuer) – all businesses in the trade register pay this at a national rate of 3.5% on profits. There is an additional local rate in municipalities with over 80,000 inhabitants. This must be at least 7%. It currently varies between 8% and 20%.

German companies, including subsidiaries, pay business tax on their worldwide income, although Germany has tax treaties with many countries to prevent double taxation. In addition, branches of foreign companies pay tax on their German income.

VAT in Germany

If you earn less than €22,000 as a freelancer in your first year, you will be classed as a Kleinunternehmer (small business owner) and be exempt from VAT. Otherwise, you can expect to pay 19% in most cases and 7% for certain goods and services, such as food and books. Restaurants and catering currently benefit from a reduced VAT rate of 7% due to the COVID-19 pandemic.

VAT returns are filed either monthly or quarterly, and you will also need to file an annual return. Should these not correspond, the tax office might contact you for an explanation.

Hiring staff in Germany

If you’re looking to grow your business or start an enterprise that involves more work than the owners can manage, you’ll need to hire additional workers. Unless you hire freelancers or self-employed workers on a contractual basis, you’ll become an employer, which means following certain procedures.

You’ll have to put all employees on the payroll and register them for tax and social security payments. Income tax in Germany is deducted from salaries at a progressive rate, with the first €9,984 being tax-free and a maximum tax rate of 45% on earnings above €277,826 (figures from 2022). Social security contributions are split 50:50 between employer and employee. Current overall rates are:

- Pensions 18.6%

- Health insurance 14.6%

- Unemployment insurance 2.4%

- Long-term nursing care 3.05% (or 3.4% for workers with no children)

- Occupational accident insurance (varies, but around 1.2% paid in full by the employer)

In addition to this, many German businesses offer occupational pension schemes to workers. This mainly occurs within large and medium-sized companies, although the German government has encouraged small businesses to implement schemes in recent years.

Employers must follow German labor laws on worker rights in employment contracts, working hours, minimum wages, paid holidays, and notice periods. If you recruit foreign workers from outside the EU, they’ll need a work visa suitable for the job. The Federal Employment Agency has issued an information booklet on employing overseas workers in Germany.

Recruiting staff in Germany

You can recruit workers through many avenues, including the Federal Employment Agency, job websites, and recruitment agencies. You can also use third-party agencies to recruit temporary workers. In this case, the agency will legally employ the workers and deal with contracts, wages, tax, and social security. However, you’ll need to adhere to the Temporary Agency Work Act and use a licensed agency.

Social security considerations for freelancers in Germany

When you work as a freelancer in Germany, you will need to organize your own social security. You won’t be expected to pay the mandatory social security contributions that apply to full-time employees, but there are several matters you should think about.

Health insurance

Everyone living in Germany needs health insurance, including those who run a business. While full-time employees usually only pay half of their health insurance costs, as a freelancer, you’ll need to organize your own. No matter your income, you may take out private or public provision.

Some artistic professionals can get health insurance through the Künstlersozialkasse. This means that self-employed artists only pay part of their insurance costs, much like those in full-time employment. Check their website to find out if this applies to you and how to benefit from it.

Pensions

It pays to think about your eventual retirement as a self-employed person, even if the law doesn’t require you to. German pensions comprise three ‘pillars’ – the state pension, voluntary pension, and private pension plans. Some freelancers, such as teachers and artists, must contribute to state pensions. Others who run a business in Germany may choose whether or not to contribute.

The second pillar is the voluntary occupational pension, which companies and employees pay into. This does not apply to fully self-employed people. On the other hand, private pension funds can be set up with an insurance provider. In addition, the German government sponsors two schemes: Riester-Rente and Rürup-Rente, which offer different benefits for self-employed people.

If you need help navigating the complex German pensions market, there are many experts who specialize in helping internationals, such as those at Pensionfriend.

Other social security benefits

If you are registered with the Künstlersozialkasse, they will handle your social security contributions. Otherwise, it’s up to you whether you want to contribute to other social security, such as unemployment benefits. If you are self-employed for at least 15 hours a week, you can make voluntary contributions to unemployment insurance.

Useful resources

- BMWI – Point of Single Contact provides information and documents for business administration in your area

- Accountable – information for freelancers on tax, administration, and how to run a business in Germany