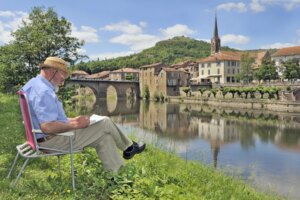

Whatever type of retirement you’re looking for, France has something to offer. From bustling cities and picture-perfect villages to the glamour of the Mediterranean coast. It’s a great place to enjoy a high quality of life, with a good state healthcare system and a reasonable cost of living.

If you plan to retire in France you need to know about pensions, taxes, and wills. These issues and more are outlined below, under the following topics:

SJB Global

Let SJB Global guide you on a range of topics including saving plans, retirement and pensions transfers, investments, and more. This financial advisor provides a remote service, so you can contact their experts at a time that suits you. Get in touch with SJB Global to find out how they could help you in your life abroad.

Retiring in France

France is one of the most popular places to retire in Europe, with expats attracted by the country’s climate, food, and lifestyle. The country is particularly popular with English, American, and German nationals looking to settle abroad.

In the 2020 OECD Better Life Index, France achieved above-average ratings in categories such as safety, housing, and health, but below-average ratings for environmental quality, jobs, and earnings.

Despite its continued popularity as a retirement destination, France only achieved mixed ratings in the 2021 Natixis Global Retirement Index, ranking 25th out of 44 countries for the second year in a row. France achieved an excellent ranking of 4th place for quality of healthcare but finished a lowly 41st for finances.

Who can retire in France?

Citizens of the European Union (EU), European Economic Area (EEA), or Switzerland will not need a visa. Non-EU citizens, however, must apply for a French visa before entering the country. The French government’s visa web portal allows you to quickly check whether you’ll need a visa to enter France.

If you’re moving to France from outside the EU, EEA, or Schengen area, you’ll need to apply for a long-stay visa (visa de long séjour), and apply for a residency permit within two to three months of your arrival (depending on the type of visa issued). This will allow you to live in the country for up to a year. Retirees may opt to apply for a visitor visa (VLTS-TS Visiteur visa). To get a visitor visa, you’ll need to prove you have sufficient income to support yourself in France (be it through pension income, savings, or investments) and show evidence of having private health insurance. In addition, you must submit a declaration stating that you won’t undertake paid work while in France.

The France visa service requires evidence that you have income or funds of at least equivalent to the French minimum wage (salaire minimum interprofessionnel de croissance – SMIC). In 2022, the SMIC is €19,237 a year before deductions for tax and social contributions. After deductions, that works out to a monthly net income of €1,266 (about €15,200 a year).

You can replace your VTLS visa with a visitor’s residency permit after a year. After five years, you can apply for permanent residency.

For advice on the processes associated with retirement in France, it’s worth getting advice from an expert. Services such as Fab Expat provide English-language guidance.

Retirement age in France

The earliest retirement age in France is 62 (60 if you were born before 1 July 1951). The French state pension age is five years later (67 or 65 based on the figures above), at which point you are entitled to draw your full pension.

Pensions in France

Retiring in France means getting to grips with the French pension system has three pillars: the state pension, compulsory supplementary pensions, and voluntary private pensions. Retirees need to work in France for at least 42 years before they can claim the full state pension. This reduces to 40 years if you were born before 1952. To claim a pro-rata pension, you’ll need to have contributed for at least 10 years.

The Wealth Genesis

At The Wealth Genesis, clients pay the same transparent fixed fee for investment and pension transfer services, eliminating conflicts of interest or surprises. The firm’s independent status gives them access to an unrivaled range of investments and products, delivering bespoke solutions to clients at the best value.

Industry bodies administer supplementary pensions that both the employer and employee pay into. Again, these pensions are usually payable at the French pension age of 65 or 67 (depending on your year of birth). The amount you’ll receive is usually based on the average of your working salary throughout your career.

Private pensions are also available in France. These types of pensions can include individual plans offered by insurance companies, company savings plans which run for a set number of years, and company pensions offered by individual organizations for their staff.

Transferring an international pension to France

You may be able to transfer your pension to France if your home country has a bilateral agreement in place, such as the bloc-wide agreement for EU nationals. UK expats can transfer their pension through a QROPS scheme, and an agreement is also in place for US citizens. Non-EU citizens should check the rules with the French consulate in their home country.

Taxes on retirement in France

Once you become tax resident in France, you must pay tax on your worldwide income. You’ll need to declare your bank accounts to the French authorities. If you fail to do so, you may incur a fine.

If you’re looking for advice on taxes in France and wondering how best to manage your retirement, a financial advisor can help. Many even offer free consultations, like The Wealth Genesis.

You’ll need to fill in an annual tax declaration, even if you’re not making any income. France has agreements with many of its European neighbors and other countries around the world. These agreements mean many people retiring to France can avoid paying taxes twice.

France imposes a wealth tax on property assets over €1.3 million. However, keep in mind that there are some exclusions. For example, if you have returned to France after residing abroad for five years only your assets in the country count in regards to the wealth tax. Likewise, if you are tax resident abroad.

Best places for expats to retire in France

House prices in France vary significantly depending on where you’re looking to buy a home.

The best place for you to retire in France depends on the kind of lifestyle you’re looking for. The country has something to offer for all types of retiree. A report published in October 2020 by the daily newspaper Le Figaro listed the top 50 towns to retire to in France, based on housing, services, weather, and social life.

Fab Expat

Need advice on your French retirement? Fab Expat’s expert network is on hand to guide you. Whether you need assistance with your pensions, wills, investments, or immigration matters, their partners can advise on the necessary processes. Book a consultation with Fab Expat today.

The top five towns were Andernos-les-Bains and Arcachon, both south of Bordeaux, Vannes (Brittany), Narbonne (Occitaine) and Saint-Hilaire-de-Riez (Vendée). Andernos-les-Bains was noted as being popular with ‘young, sporty retirees’ looking for a more active retirement.

Of course, among the best places to live in France are popular locations such as Paris, Brittany, Aix-en-Provence, Bordeaux, and the Dordogne.

Services, organizations, and clubs for older expats in France

Getting involved in the local community by joining a club or expat group can be a great way of settling into life when retiring in France.

There are plenty of English-speaking organizations to choose from. As a starting point, you can search this directory of expat groups and clubs in France, which includes contact details for various organizations based on nationality and common interests. You can also explore local groups on Facebook or Meetup.

Wills and inheritance in France

French inheritance laws operate on a residence-based system. This means that if you die in France, French rules will apply by default, regardless of your nationality. There is a way around this, however. You can state in your will that you want the laws from your home country to apply instead. With this in mind, it’s important to make sure you write a French will expressing your wishes.

Inheritance in France works on a forced heirship basis. Children are considered reserved heirs. This means they receive a set amount of their parent’s estate by default. If there is one child, they receive 50% of the estate, two children receive 66.6% between them, and three or more receive 75% of the estate between them.

Spouses are exempt from paying French inheritance tax, but all other relatives must pay tax on a sliding scale. For example, children and grandchildren pay nothing on the first €100,000, and then 5% to 45% on the remainder. Other relatives have much smaller allowances and must pay inheritance tax at a higher rate.

Healthcare for retired expats in France

France has a high-quality healthcare system, which is funded by mandatory health insurance contributions from workers. The state healthcare system in France operates on a co-payment basis, whereby the majority of medical costs are reimbursed.

For example, when you go to the doctor, you’ll usually have around 70% of your costs reimbursed, or 80% when you go to a hospital. Optional private health insurance coverage is also available. Many French residents and expats choose to top up their coverage with a private plan.

Private insurance can also cover specialist treatment or complementary therapies not available through public healthcare.

Retirees from the EU, EEA, the United Kingdom, or Switzerland can access state healthcare services by completing an S1 social security form in their home country. If you’re from outside of the EU, you’ll likely need to take out private health insurance.

To be accepted for long-term French residency, you’ll need to have a medical plan in place. Once you’re officially a French resident, you’ll then be able to access the state healthcare system.

Before getting full access to the state healthcare system, you can use these trusted international policies to bridge coverage gaps:

Useful resources

- Official visa guidelines – for a useful visa checker tool

- France-Visas – for official updates on immigration issues

- OECD Better Life Index – for key indicators on France