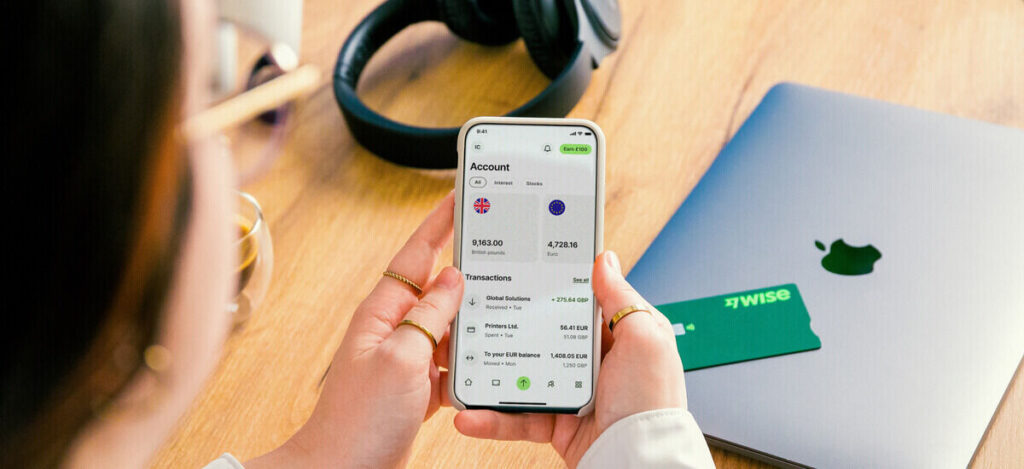

Wise offers a simpler way to stay in control of your finances. With a multi-currency account, local EUR details, and a debit card that works almost anywhere, it helps you build independence, and feel more at home in Germany. Let’s have a closer look:

- At a glance: Wise in Germany

- About Wise

- How to use Wise to transfer money

- How to open a Wise multi-currency account

- How to use Wise account in Germany

- How to get a Wise card in Germany

- How to use the Wise card in Germany

- Using Wise Business Account in Germany

- Wise large amount transfers

- Is Wise safe to use?

- Is Wise regulated in Germany?

- How to contact Wise customer service in Germany

Wise Account

Settle into life in Germany without the banking headache. Wise is the ultimate financial companion for expats. Get your own local EUR account details instantly, so you can receive your salary and set up direct debits like a local from day one. No hidden fees, no border restrictions—just seamless money management.

At a glance: Wise in Germany

With a Wise EUR account, expats in Germany can receive local payments just like residents. You’ll get your own European IBAN, so your employer can deposit your salary and you can set up direct debits for rent, utilities, or everyday subscriptions. It’s an easy way to stay connected to the local banking system while keeping flexibility for managing international finances.

| 💡 Using Wise in Germany | |

|---|---|

| Wise money transfers | Send money to more than 140 countries at the mid-market exchange rate, with transparent fees and fast delivery times. |

| Wise account | Hold and convert over 40 currencies, receive payments with account details for in 20+ currencies with 8+ account details, and manage everything from one secure app. |

| Wise card | Spend in 150 countries using your Wise debit card and pay directly in local currency to avoid conversion markups and hidden fees. |

| Wise business account & card | Pay a one-off 45 EUR fee to unlock full business features, including 8+ account details to receive money in 22 currencies. Send fast payment links, pay invoices instantly and manage batch payments. |

| Wise large transfers | Move high-value payments safely with no exchange rate markups. You’ll get automatic discounts on large amounts, fast delivery, and dedicated support for transfers over 20,000 GBP (or the equivalent in euros.) |

About Wise

Wise is a global financial technology company that helps people send, spend, convert and manage money across borders with transparency and low fees. Trusted by over 15.6 million customers worldwide, it was created to make international banking fairer and more accessible, using the mid-market exchange rate without hidden markups.

For expats in Germany, Wise’s multi-currency account is a convenient way to stay financially connected to more than one country. You can receive your salary in euros, pay bills locally, send money back home, or travel abroad, all from one account. Everything is managed through an easy-to-use app designed to help expats stay in control of their money wherever life takes them.

How to use Wise to transfer money

Making international transfers straightforward for expats in Germany, Wise lets customers see the mid-market exchange rate and total fee before confirming a payment – meaning no hidden costs or unwanted surprises. Most transfers arrive within minutes to a day, and you can send money directly from your Wise balance or linked bank account.

How to send money with Wise

- Create or log in to your Wise account: Start by signing up or logging in to your Wise account using your email and password. You’ll need to verify your identity before sending your first transfer.

- Go to “Send” in your account: From the home screen, select Send to begin your transfer.

- Add or choose a recipient: You can pick an existing recipient or add a new one by entering their bank details, email, or @Wisetag.

- Enter the amount and currency: Decide how much you want to send or how much your recipient should receive. Wise will show the exact fee, exchange rate, and total cost before you confirm.

- Choose your payment method: Pay directly from your Wise balance, by bank transfer, or using another available option. The app will show you how long each payment method usually takes.

- Review and confirm: Double-check your details, then confirm the transfer.

- Receive confirmation: You’ll get an instant notification when your money is received and again when it’s on its way to the recipient.

Once your transfer is sent, you can track its progress in real time in the Wise app or on the website. Updates appear automatically, so you’ll always know where your money is and when it will arrive.

How to open a Wise multi-currency account

Opening a Wise multi-currency account in Germany only takes a few minutes and gives you a simple way to manage global finances from one place. You can hold and exchange over 40 currencies at the mid-market rate and receive payments in more than 20 currencies with 8+ local account details. Once your account is verified, you can add money in euros or any other currency and start spending or sending internationally right away.

How to open your Wise account

- Register on Wise.com or the Wise app: Create your account online or download the Wise app for Android or iOS. You can register with your email address or sign up using your Google, Apple, or Facebook account.

- Choose your account type: Select a personal or business account, then confirm that you live in Germany.

- Add your personal details: Enter your legal name, date of birth, and home address to help Wise verify your identity.

- Verify your phone number: Wise will send a security code by text message. Enter the code in the app to confirm your number and secure your account.

- Upload ID for verification: Provide a photo ID such as a passport or driving licence, and proof of address like a recent utility bill. Verification usually takes 1-2 working days.

- Open a balance in euros: Once verified, create a EUR balance to start using your account in Germany. You can also open balances in other currencies when needed.

- Add money to your account: Top up your balance in euros or another currency using your linked bank account, debit card, or another available method. Your funds will then be ready for sending, spending, or converting.

How to use Wise account in Germany

Tthe Wise multi-currency account offers an easy way to manage both local and international finances. You can get paid like a local with your own EUR IBAN, making it simple to receive a salary or move larger sums across Europe.

What you can do with your Wise account

- Hold and convert money in more than 40 currencies whenever you need, using the real mid-market rate.

- Spend worldwide with the Wise debit card, accepted in over 150 countries for online and in-store purchases.

- Receive international payments with account details for 20+ currencies with 8+ account details, including EUR, USD, GBP, and AUD.

- Send money directly from your Wise balance to friends and family, often at a lower cost than bank transfers.

- Pay bills and subscriptions in Germany using your EUR balance and German IBAN.

- Shop safely online with digital or virtual cards that can be managed in the app.

- Save and plan ahead by setting up “jars” or “groups” to keep money separate for specific goals.

How to use Wise to receive money

Receiving money with Wise is flexible and low-cost, whether funds are sent from Germany or abroad. You can get paid directly into your Wise account using the account details for your chosen currency, or have money sent to your regular bank account.

If you’re receiving euros, Wise gives you a personal EUR IBAN that supports SEPA transfers, making it easy for employers, friends, or clients in Germany and across Europe to pay you locally. Receiving EUR payments is free, apart from SWIFT payments, and transfers usually arrive within seconds.

You can also receive international payments through your Wise account. If you have account details in currencies like USD, GBP, AUD, or CAD, senders can pay you as if you had a bank account in that country. These transfers are free in most currencies, although incoming USD wires have a small fixed fee.

For payments made via SWIFT, Wise supports incoming transfers with low fixed fees per transaction, which vary by currency. A convenient option for expats who receive income or pensions from abroad, Wise lets you hold the money in a foreign currency or convert it to euros when the rate suits you.

How to get a Wise card in Germany

The Wise debit card makes it easy to spend and withdraw money worldwide without hidden fees or exchange rate markups. It’s linked directly to your Wise multi-currency account, so you can spend in euros or convert and pay in over 40 currencies at the mid-market rate. The card costs a one-time fee of 7 EUR, with optional express delivery from 10.40 EUR if you need it sooner. Standard delivery in Germany usually takes up to 14 days.

How to order your Wise card

- Open your Wise account: Sign up for a free Wise account and open your first currency balance in euros. You’ll need to verify your identity before ordering the card.

- Go to the “Cards” tab: In the Wise app or website, select Cards and follow the steps to order your physical card.

- Pay the one-time order fee: The Wise card costs 7 EUR to issue, and you can pay this directly from your Wise balance or linked bank account.

- Choose your delivery option: Standard delivery within Germany takes up to 14 days. For faster service, choose express delivery, which typically arrives within 1 to 2 working days for an additional fee.

- Activate your card: Once it arrives, activate your card by making a Chip and PIN purchase. After activation, it’s ready to use for spending, making withdrawals, and online shopping anywhere Visa or Mastercard is accepted.

How to use the Wise card in Germany

The Wise debit card lets expats spend and withdraw money globally, while saving on hidden fees. You can pay in shops, restaurants, and online in over 150 countries using funds from your Wise account. Each payment is automatically converted at the mid-market exchange rate, helping you get more from every euro.

In Germany, you can use the Wise card wherever Mastercard or Visa is accepted, and link it to Google Pay or Apple Pay for contactless payments. However, some local merchants still only accept EC-Karte (Girocard) payments, especially in smaller towns or independent shops. It’s best to check for the Mastercard or Visa logo before paying and to always keep some cash on hand for places that don’t yet support international debit cards. You can withdraw up to 200 EUR per month for free from ATMs, with a small fee applying to higher or more frequent withdrawals.

Using Wise digital cards

Wise digital cards give you all the same benefits as the physical card, with an added layer of security. You can create up to three digital cards in seconds through the Wise app and use them immediately for online shopping or contactless payments via Apple Pay or Google Pay. Each card can be frozen, unfrozen, deleted or replaced instantly, and you’ll receive a notification every time a transaction is made.

Using Wise Business Account in Germany

Thanks to the Wise Business Account, feelancers, entrepreneurs, and international companies in Germany can manage global payments in one place. You can send, spend, convert and receive money in multiple currencies while keeping fees low and exchange rates transparent. The account costs a one-off 45 EUR to unlock all features, including 8+ account details to receive payments in 22 currencies and business debit cards for you and your team.

Opening an account only takes a few minutes – just register online, verify your business details, and pay the 45 EUR setup fee. You can then order your Wise Business card, open balances in different currencies, and start managing payments from one dashboard.

What you can do with Wise Business in Germany

- Get paid like a local with EUR, USD, GBP and other account details to receive international transfers easily.

- Send and receive payments worldwide with transparent, low fees and no exchange rate markups.

- Pay invoices and suppliers instantly – over half of Wise Business transfers arrive within 20 seconds, and 95 percent within 24 hours.

- Use batch payments to send up to 1,000 transfers in one go and save valuable time on admin.

- Spend with business debit cards for you and your team, keeping company and personal spending separate.

- Earn returns on your EUR balance every working day, with funds available whenever you need them.

- Sync with accounting tools for automated reconciliation and accurate reporting.

- Benefit from volume discounts when sending more than 20,000 GBP (or the equivalent in euros) in a month.

Wise large amount transfers

If you’re transferring savings or paying for property abroad, Wise makes it simple to move larger sums internationally while keeping costs low. You can send high-value payments with no exchange rate markups, full fee transparency, and access to dedicated customer support if you need help.

You’ll also benefit from automatic volume discounts once your total transfers or conversions reach the monthly threshold of 20,000 GBP, or the equivalent in EUR. The discount applies to any additional transfers for the rest of the month, whether sent in one payment or across several. Major currencies such as EUR, USD, GBP, and JPY all count toward this limit, and the reduced fee is applied automatically. For larger transfers, Wise also provides extra support and the same transparent pricing that helps expats and businesses save money when sending funds internationally.

Is Wise safe to use?

Wise uses advanced technology and strict security systems to protect your money and personal information. Your funds are safeguarded and kept separate from Wise’s own accounts, so they’re always available when you need them. Dedicated anti-fraud teams monitor transactions around the clock, and every step of your account activity is secured by multiple layers of protection.

Key security measures

- Two-step authentication confirms it’s you before any important action, from login to payment.

- Biometric verification and encryption use your phone’s built-in security for extra protection.

- Customisable privacy controls let you hide balances, manage permissions, and set auto log-out.

- Real-time notifications help you track every transaction instantly.

- Digital cards create unique payment details to keep your main card information safe.

- Instant freeze option allows you to lock your card immediately if it’s lost or stolen.

- 24/7 security monitoring with over 1,000 specialists and machine learning tools that detect suspicious activity.

You can learn more about how Wise keeps your money secure on the Wise safety and security page.

Is Wise regulated in Germany?

Wise operates in Germany under Wise Europe SA, an authorised payment institution supervised by the National Bank of Belgium. The company is incorporated in Belgium and has passporting rights across the European Economic Area (EEA), allowing it to provide services throughout the region.

How to contact Wise customer service in Germany

Wise offers dedicated customer support for personal and business users in Germany, and you can reach the team in English 24/7. The Help Centre is usually the fastest way to find answers, but you can also speak directly with a team member by logging in to your account.

Ways to contact Wise customer service

- Help Centre: Visit the Wise Help Centre for quick answers to common questions.

- In-app support: Log in to your account on the app or website and select Help or ? to access personalised support options.

- Chat or email: Contact the support team directly through live chat or email after logging in.

- Phone support: Call the Wise team by logging in to find your local number.

- If you can’t log in: Go to the Help Centre, scroll to the bottom of any article, and select Contact us to send an email explaining your issue.

Useful resources:

- Wise Pricing – Germany – Overview of fees, limits, and card availability in Germany

- Wise Help Centre – Order your card – Step-by-step guide to ordering and activating your Wise card

- Wise Help Centre – Spending limits – Default and maximum limits by payment type

- Wise Help Centre – Smart Conversion – How Wise automatically selects the best currency for your payment

- Wise Help Centre – Supported countries – Where the Wise card can be used worldwide