This guide walks you through how to open a business account and which banks and providers are best for expats and non-residents. Alongside traditional Dutch banks, we’ll also take a look at Wise Business, which makes it easier to hold and manage multiple currencies, pay suppliers abroad and keep your bookkeeping organised with handy software integrations.

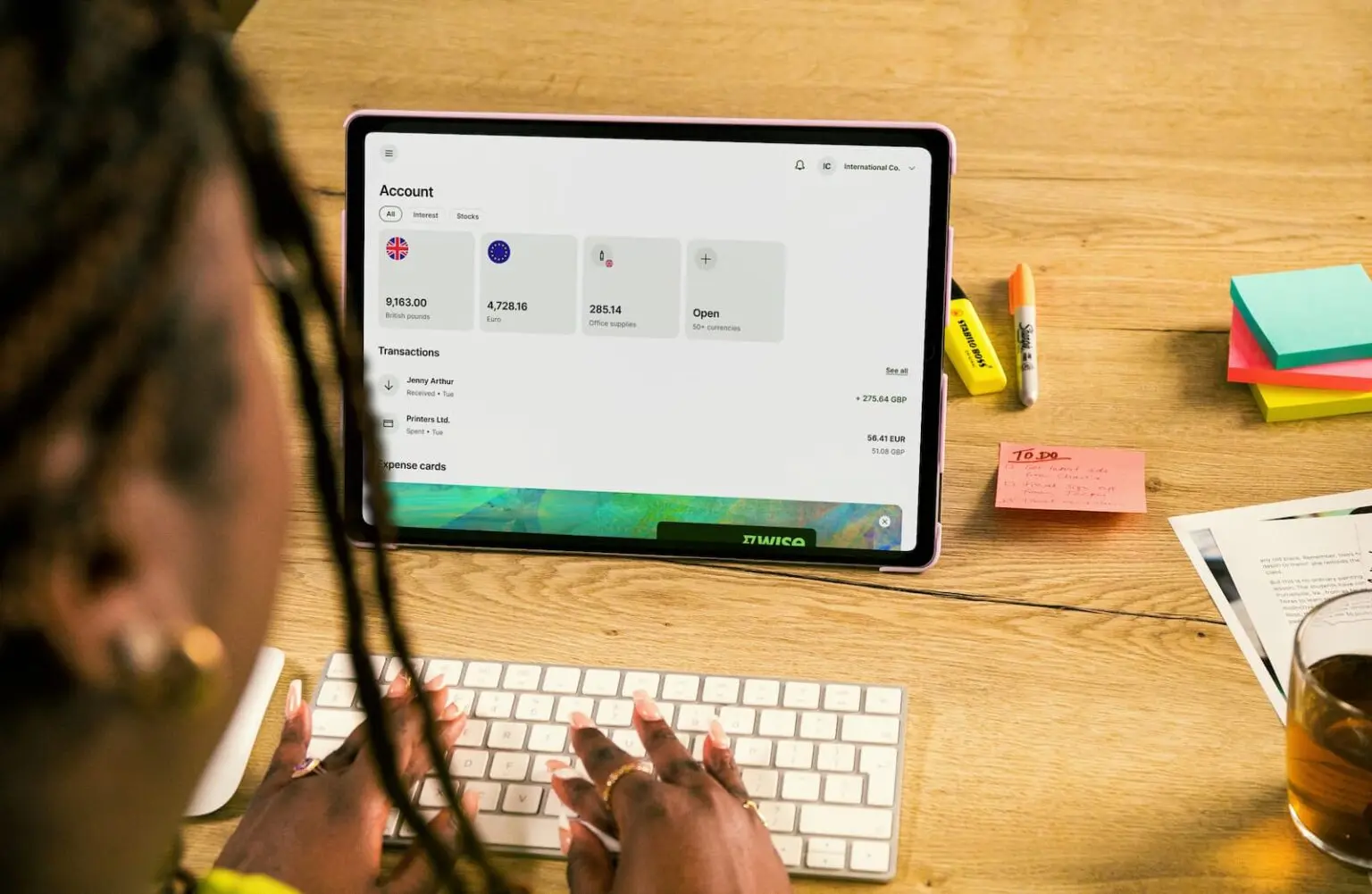

Run your company finances smarter with Wise Business

Open local account details in GBP, EUR, USD and more, so international clients can pay you as easily as a neighbour would. Hold and manage 40+ currencies in one place, convert at the mid-market exchange rate and cut transfer fees that start from just 0.47%. You can also connect Wise to tools like Xero or QuickBooks to save time on bookkeeping. Over 700,000 businesses already trust Wise for faster, cheaper international payments, with more than 60% of transfers arriving instantly.

Table of contents

- Can a foreigner open a business bank account in the Netherlands?

- What is the KVK number and Quick Scan?

- Best business bank accounts in the Netherlands

- Top 5 best business bank accounts in the Netherlands [2025]

- How to choose the right account for your business

- How to open a business bank account in the Netherlands

- Benefits of opening a separate business account

- Conclusion

Can a foreigner open a business bank account in the Netherlands?

Yes, foreigners can open a business account in the Netherlands under certain conditions. It often depends on your business structure, whether you have a SEPA-IBAN already, and if you meet Dutch regulatory requirements such as being registered with the Kamer van Koophandel (KVK). Agencies like the Dutch Banking Association (NVB) provide a “Quick Scan” tool to help non-resident entrepreneurs figure out if they can open a Dutch IBAN business bank account.

Banks like ING, ABN AMRO and Rabobank are known to accept foreign-owned companies for business accounts, though they may ask for extra documentation, proof of address, or references. Digital providers including Wise may offer more flexible options if you don’t have a Dutch address yet or if your business operates across borders.

Insider Tip: If you already hold a business bank account within a SEPA-zone country with an IBAN, you might not need to open another one in the Netherlands. A SEPA IBAN allows you to do cross-border euro payments easily without needing local Dutch banking.

What is the KVK number and Quick Scan?

A KVK number is the registration number your business receives when it’s officially listed with the Dutch Chamber of Commerce (Kamer van Koophandel, or KVK). Almost all companies operating in the Netherlands have to register here before they can apply for a business bank account. The KVK number confirms your company’s legal existence and is often required when paying taxes or opening financial services.

For foreign entrepreneurs, Dutch banks may also request the Quick Scan “Dutch Business Bank Account” developed by the Dutch Banking Association (NVB). It’s a tool that helps international businesses check if they’re eligible to open a Dutch IBAN account and is designed for companies that are in the process of registering with the KVK and applying for residence permits.

If your business is supported by the Netherlands Foreign Investment Agency (NFIA) or a recognised start-up facilitator, you can fill in the Quick Scan and submit it to participating banks (such as ABN AMRO, ING, or Rabobank). Within five working days, the bank will let you know if you can proceed with a full application.

How to get a KVK number and use the Quick Scan

- Register with the KVK: Visit the Chamber of Commerce (kvk.nl) and submit your company details, legal structure and proof of identity. Once approved, you’ll receive your KVK number.

- Check your eligibility: If you’re a foreign entrepreneur, download the Quick Scan form from the NVB (Dutch Banking Association) website.

- Provide supporting documents: Attach proof of NFIA support or a start-up facilitator agreement along with your application.

- Submit to your chosen bank: Send the completed Quick Scan to a Dutch bank such as ING, ABN AMRO, or Rabobank.

- Wait for confirmation: Within five business days, the bank will indicate whether your application for a business account is likely to succeed.

Best business bank accounts in the Netherlands

Finding the right business account in the Netherlands depends on what type of company you run, where you’re based and how you plan to get paid. To give you a balanced view, we’ve compared a mix of major Dutch banks and newer fintech providers.

Methodology: We’ve compared accounts using practical criteria that matter most for global entrepreneurs, such as:

- Fees: Monthly account costs, local payment charges and international transfer fees.

- Ease of use: Online banking and speed of setup.

- Non-resident accessibility: Whether foreigners and non-EU nationals can apply.

- Currency support: The ability to manage or transfer money in multiple currencies.

Picking the right account can help cut costs, speed up payments and make bookkeeping more manageable. The Dutch market offers established names like ING and ABN AMRO with digital alternatives such as Wise, Revolut and Finom, giving international entrepreneurs plenty of choice.

Here’s a side-by-side comparison of key features and fees, with more detail on each provider just after.

| Provider | Monthly fees | Available for non-residents | International transfer fees | Currency support | Ease of use | Key features |

|---|---|---|---|---|---|---|

| Wise Business | Free to open, no monthly fees | Yes | Low conversion fees from 0.47% and the mid-market rate | 40+ currencies including EUR, USD, GBP | Fast online setup | Local account details in multiple currencies, debit cards and accounting integrations |

| Finom | From 0 EUR to 249 EUR depending on your chosen plan | Yes | From 0.10%–1% depending on your chosen plan | Exchange 17 currencies | Open online in minutes | Cashback on cards, invoicing tools, accounting integrations, mobile-first dashboard |

| Revolut Business | From 10 EUR to custom enterprise pricing | Yes (EEA, UK, US, etc.) | Free transfers within your plan allowance, then low fees | 25+ currencies | Quick online setup | Dutch IBAN, cards for team, expense management, savings options |

| ING Business | Free for 6 months (Startup), then 9.90 EUR/month (Entrepreneur) | Yes, if the business is registered with the KVK (extra checks may apply). | SEPA transfers are free | EUR accounts (foreign currency accounts cost extra) | Online and branch support | Debit card, accounting integration, ING Business app |

| ABN AMRO Business | From 9.90 EUR to 22.25 EUR per month depending on thepackage | Yes, if the business is registered with the KVK (higher fees possible for non-residents). | SEPA transfers from 0.12 EUR, international transfers from 12 EUR | EUR accounts – open a foreign currency account from 8 EUR per month | Online and branch support | Bookkeeping connection, debit cards and savings account options |

Top 5 best business bank accounts in the Netherlands [2025]

Business owners in the Netherlands have plenty of choice, from long-established Dutch banks to modern fintech providers. Traditional banks usually ask for more paperwork, while fintechs often move quicker with online onboarding. To help you compare, we’ve highlighted five accounts worth looking at in 2025, with notes on costs, features and how welcoming they are to non-residents.

1. Wise Business Account

💡 Great for: Managing cross-border payments and multi-currency balances with low, transparent fees

Wise Business is trusted by over 700,000 companies worldwide, from freelancers to scale-ups. With one account, you can hold 40+ currencies (including GBP, EUR, and USD), pay suppliers or staff in seconds, and get local bank details in multiple countries to make it easier for overseas clients to pay you.

Over 50% of transfers arrive in under 20 seconds, and 95% land within 24 hours. Businesses can also issue debit cards for team members, set spending limits and integrate directly with popular accounting software like Xero and QuickBooks.

- Account fees: Free registration. One-time 60 EUR to unlock local account details. No ongoing monthly fee.

- Supported currencies: 40+ including GBP, EUR, and USD.

- International payments: Fees vary by currency, starting from 0.47%.

- Exchange rates: Always at the mid-market rate, with no hidden markups.

- Eligibility criteria: Available to Dutch businesses, freelancers and non-resident companies.

- Required documents: KVK registration, proof of identity for directors and stakeholders, business details (registered address, trading address, industry), and ownership structure.

2. Finom Business Account

💡 Great for: Freelancers and small businesses looking for fast setup with cashback perks and integrated invoicing.

Finom is a Dutch fintech that combines banking, payments and accounting. You can open an account online in under 15 minutes and receive a Dutch IBAN within 24 hours, so you can start invoicing clients right away.

Finom offers free physical and virtual cards, with cashback of up to 3% depending on your plan, and built-in invoicing tools that let you issue multilingual invoices in seconds. Funds are safeguarded by BNP Paribas and supervised by De Nederlandsche Bank (DNB).

- Account fees: Pricing starts from 0 EUR for Solo freelancers, 14 EUR per month for Microbusiness (Basic), and 36 EUR per month for SMEs (Pro). Higher tiers unlock perks like more users, advanced expense management and up to 1% cashback.

- Supported currencies: EUR with options to send and receive international payments in 150+ countries.

- International payments: Fees range from 1% (Solo) down to 0.10% (SMEs Grow plan).

- Exchange rates: Interbank exchange rate, plus a 0.5% markup

- Eligibility criteria: Available to freelancers, SMEs and companies registered in the Netherlands.

- Required documents: Company details, proof of ID for representative, and KVK registration.

3. Revolut Business Account

💡 Great for: Managing money across multiple currencies with flexible plans for growing businesses.

Revolut Business gives companies in the Netherlands a way to run their finances locally and internationally from one app. You can hold and exchange 25+ currencies at the interbank rate and send transfers to over 150 destinations. You can also receive money with Dutch IBAN and SWIFT/BIC details. The account connects to iDEAL for local payments, making it easier to bill clients or pay suppliers in the Netherlands.

Teams benefit from physical and virtual cards with built-in spend controls, plus automations that save time on expenses and invoicing. Businesses looking to grow can also access savings options with variable daily interest, integrations with accounting tools like Exact Online or SnelStart, and higher allowances with paid plans.

- Account fees: Plans start at 10 EUR per month (Basic), 30 EUR month (Grow), 90 EUR per month (Scale). Enterprise plans are custom.

- Supported currencies: 25+ including GBP, EUR, and USD.

- International payments: No-fee transfers included within plan allowance. Extra transfers incur low fees depending on tier.

- Exchange rates: Interbank rate up to allowance during market hours. Additional exchanges or weekend trades include a small markup.

- Eligibility criteria: Available to incorporated businesses registered in the Netherlands and other eligible countries in the EEA, UK, US, Switzerland, Singapore and Australia.

- Required documents: Company registration with KVK, proof of address, ID for directors/UBOs and business activity details.

4. ING Business Current Account

💡 Great for: Entrepreneurs who want a Dutch bank with local credibility and easy accounting integration.

ING is one of the largest banks in the Netherlands and offers two main packages for business customers. If you’ve registered with the Chamber of Commerce (KVK) within the last year, you can start with the free Startup Business Package. It includes a current account, a corporate debit card, access to the ING Business app, and even six months of business liability insurance. After the first six months, accounts move automatically to the Entrepreneur Package, which costs 9.90 EUR per month.

Both packages include free digital euro payments within SEPA, accounting software integration and online banking through My ING Business. ING is also known for offering in-branch support for those who prefer face-to-face banking – something many expats find reassuring when setting up their finances in the Netherlands.

- Account fees: Free for the first six months (Startup Package). 9.90 EUR per month for the Entrepreneur Package. Additional fees apply for deposits, more than two legal representatives, and some account services.

- Supported currencies: EUR for daily use. Foreign currency accounts are available at 6 EUR per month.

- International payments: SEPA transfers are free. Other international transfers incur standard bank charges.

- Exchange rates: ING applies its own rates, with costs included in the margin.

- Eligibility criteria: Available to businesses registered with the Dutch Chamber of Commerce (KVK). Some exceptions apply for associations, foundations and religious communities.

- Required documents: Proof of KVK registration, ID for all representatives and company details.

5. ABN AMRO Business Account

💡 Great for: Entrepreneurs who want tiered account options with add-ons for growing businesses.

ABN AMRO offers three main packages for business customers: Slim, Ambitieus and Grenzeloos. All include a business current account, a debit card, internet banking and mobile app access. Startups benefit from the first three months free, and each package scales with features like bookkeeping connections, multiple debit cards and telephone support. You can also open up to two linked savings accounts at no extra cost, and all accounts integrate with accounting tools for easier financial management.

- Account fees: Slim 9.90 EUR per month, Ambitieus 13.75 EUR permonth, Grenzeloos 22.25 EUR per month (first 3 months free). High monthly maintenance fees apply for non-residents: 105 EUR (Dutch international residents), 110 EUR (non-Dutch EEA residents), and 270 EUR (non-EEA residents).

- Supported currencies: Mainly EUR – foreign currency accounts are available for 8 EUR per month.

- International payments: 0.12-0.15 EUR within SEPA, 12 EUR outside SEPA or in foreign currency.

- Exchange rates: The bank’s own exchange rate applies with a markup.

- Eligibility criteria: A valid Chamber of Commerce (KVK) registration and ID.

- Required documents: Valid ID, KVK registration number and verification via the ABN AMRO app

How to choose the right account for your business

Choose a business account that fits how you operate day to day. In the Netherlands you can go with a well-known bank for in-branch support and local credibility, or pick a fintech for quick onboarding and modern tools. The best choice depends on where your money comes from and what you need your account to do.

Fees and running costs: Look beyond the headline price. Check monthly charges, card fees and what you pay for extra users or features you’ll actually use.

Multi-currency support: If you invoice or pay in GBP or USD, pick an account that lets you hold and convert currencies at competitive rates, ideally with clear pricing.

International transfers: Compare both the transfer fee and the exchange rate. Transparent providers show the full cost before you send and often deliver faster.

Cards and team spend: Decide how many cards you need, then check for spend limits, virtual cards and real-time controls to keep expenses tidy.

Integrations and automation: Linking your account to tools like Xero, Exact, or QuickBooks saves time. Batch payments, payment links and invoicing can reduce admin.

Eligibility and setup: Check KVK requirements, what documents are needed and how long approval takes. Some providers onboard online in days, while others take longer.

How to open a business bank account in the Netherlands

Opening a business account in the Netherlands is usually a step-by-step process that depends on your business type, residency status and the provider you choose. Most banks and fintechs require KVK registration and documents that show how your company is structured. Here’s how it generally works:

Step 1: Understand the requirements

Check the eligibility criteria of the provider you want to use. Traditional banks typically require your business to be registered with the Kamer van Koophandel (KVK), while fintechs like Wise Business or Revolut may allow non-resident applications if you have a registered company in an eligible country. Some banks may also request a Dutch business address.

Step 2: Gather your documents

Have your paperwork ready before you apply. You’ll usually need your KVK number, valid ID or passport for all directors and ultimate beneficial owners (UBOs), and your company formation documents such as articles of association. Documents issued outside the Netherlands may need to be translated or legalised with an apostille.

Step 3: Choose your provider

Decide whether a Dutch high-street bank or a digital provider works better for you. ING and ABN AMRO offer full-service accounts with in-branch support, while fintechs like Wise and Finom let you apply online and often approve accounts faster.

Step 4: Submit your application

Most applications can be started online, though traditional banks may require an in-person meeting. You’ll be asked to provide your documents, answer questions about your business activities and complete an identity check.

Step 5: Verification and approval

The bank or provider will review your application, which includes anti-money laundering checks. This process can take anywhere from a few days to several weeks, depending on your status as a resident or non-resident.

Step 6: Start using your account

Once approved, you’ll receive your IBAN, debit cards and access to online or app-based banking.

Benefits of opening a separate business account

Keeping business and personal finances separate makes life easier when you’re managing expenses, filing taxes, or applying for credit. Freelancers and sole proprietors can technically use a personal account, but a dedicated business account adds credibility with clients and avoids mixing up personal purchases with business costs. For larger businesses and incorporated companies (like a BV or NV), a business account is also mandatory under Dutch law.

Conclusion

Business owners in the Netherlands have plenty of choice, from traditional banks with local branches to modern providers that focus on speed and international payments. The best account for you really depends on how your business is set up and where your clients or suppliers are based.

If you like having a branch to visit, banks like ING or ABN AMRO will do the job. But if you’re dealing with customers or partners abroad, Wise Business is often the easier pick. You can hold 40+ currencies in one place, send and receive money without hidden fees and keep track of everything in real time.

Set up a Wise Business account today and spend less time worrying about bank fees and more time growing your company.

Can a Non-resident open a business bank account?

Non-residents can open a business bank account in the Netherlands, but the process depends on your business structure and the bank’s policies. Most Dutch banks require a registration with the Chamber of Commerce (KVK) and may ask for a Dutch business address. Some providers, like Wise Business or Revolut Business, are more flexible and offer remote onboarding for non-resident entrepreneurs.

Is it a good idea to use a personal bank account for a business?

Using a personal account for business payments and income is rarely a good idea. It makes bookkeeping messy and can cause issues when filing taxes. A dedicated business account keeps things clean, helps you separate personal and professional spending, and often unlocks useful features like invoicing, debit cards for your team and easier accounting integrations.

What is the cheapest business bank account?

The lowest-cost business bank account depends on what services you need. Fintech providers like Wise Business and Finom offer low monthly fees and transparent pricing for international transfers. Traditional banks such as ING and ABN AMRO charge from around 9.90 EUR per month, but may also include extras like liability insurance or savings options. Think about how often you’ll need to transfer internationally, as this is where costs can really add up.

Do I Have to Pay Corporate Tax in the Netherlands?

If your company is registered in the Netherlands or earns income here, you’re usually subject to Dutch corporate tax. The rate is 19% on profits up to 200,000 EUR, and 25.8% on anything above that. Even non-resident businesses may face tax obligations if they have a permanent establishment or branch in the country, so it’s worth checking your situation carefully with a tax advisor.

Useful resources

Business.gov.nl: Dutch government portal for entrepreneurs, with guidance on opening and managing a business account in the Netherlands (checked September 2025).

KVK (Netherlands Chamber of Commerce): Official site for business registration and information on legal structures and requirements (checked September 2025).

Nederlandse Vereniging van Banken (NVB): Dutch Banking Association’s Quick Scan for checking eligibility to open a business bank account as a foreign entrepreneur (checked September 2025).

Belastingdienst: Dutch Tax and Customs Administration website with information for businesses on corporate tax, VAT, and compliance (checked September 2025).

Wise Business: Multi-currency business account with transparent fees, 40+ supported currencies, and accounting integrations (checked September 2025).

Revolut Business: Digital-first account with multi-currency support, spend controls, and global transfer features (checked September 2025).

ING Business: Dutch high street bank offering Startup and Entrepreneur packages for business accounts (checked September 2025).

ABN AMRO Business: Comprehensive banking solutions for SMEs and corporates, including English-speaking support (checked September 2025).

Finom: Dutch fintech providing fully online business accounts, invoicing tools, and cashback (checked September 2025).