The Netherlands has long been at the forefront of the technological revolution when it comes to your personal finances. Mobile banking is just one of these advances, with over half of all Dutch residents having an account. Whether you’re looking to pay your bills or make payments with ease, find out more about mobile banking in the Netherlands with our guide.

ING

Trust ING for your banking in the Netherlands. ING provides a wide range of services, including bank accounts, savings, loans, investments, insurance, and more. With tools to compare and calculate your options, they help you make the right financial decisions. Visit ING online and let your money go further.

Mobile banking in the Netherlands

Banking has changed considerably since the advent of the internet and smartphone devices, and the Dutch have embraced the new options these changes have brought more than most. According to recent EU figures, 89% of the Dutch population use online banking, the third-highest in the EU/EEA behind only Iceland and Norway. Around 66% of the population use mobile banking in the Netherlands, including 60% of 50-64 year olds.

Most Dutch banks now offer internet and mobile banking services. These include high-street banks such as ABN AMRO, ING, and SNS as well as newer online banks. Online-only providers offering mobile banking in the Netherlands include:

Features of mobile banking

Mobile banking uses apps on mobile devices such as smartphones and tablets. Users can then perform banking functions from their device. Each bank offering mobile banking in the Netherlands has its own app. Customers can use them for things such as:

- Making bill payments and paying for goods in shops.

- Transferring money from one account to another or paying money to friends.

- Monthly budgeting using online tools.

- Contacting banking staff for advice or problem-solving via social media accounts.

- Accessing money from mobile accounts across the globe.

- Having round-the-clock 24/7 access to account services.

Mobile banking provides many benefits for expats in the Netherlands including making cross-border payments and moving money between accounts that use the euro, immediacy of service, and lower banking costs. With bunq, you can open an account in minutes and make multi-currency payments and overseas card transactions at much cheaper rates.

bunq

Looking for a Dutch mobile bank? With bunq, you can open a full Netherlands bank account in just five minutes using nothing more than your mobile phone. You get real-time access to your account, instant payments and dedicated customer support available in English, Dutch, German, Italian and Spanish.

There are still some limitations with mobile banking in the Netherlands as well as elsewhere. Loan services are limited, as is the ability to transfer money to foreign currency accounts. Internet availability can also be an issue; mobile banking relies on a data connection, although Wi-Fi and internet coverage in the Netherlands is generally quite good.

Making mobile payments in the Netherlands

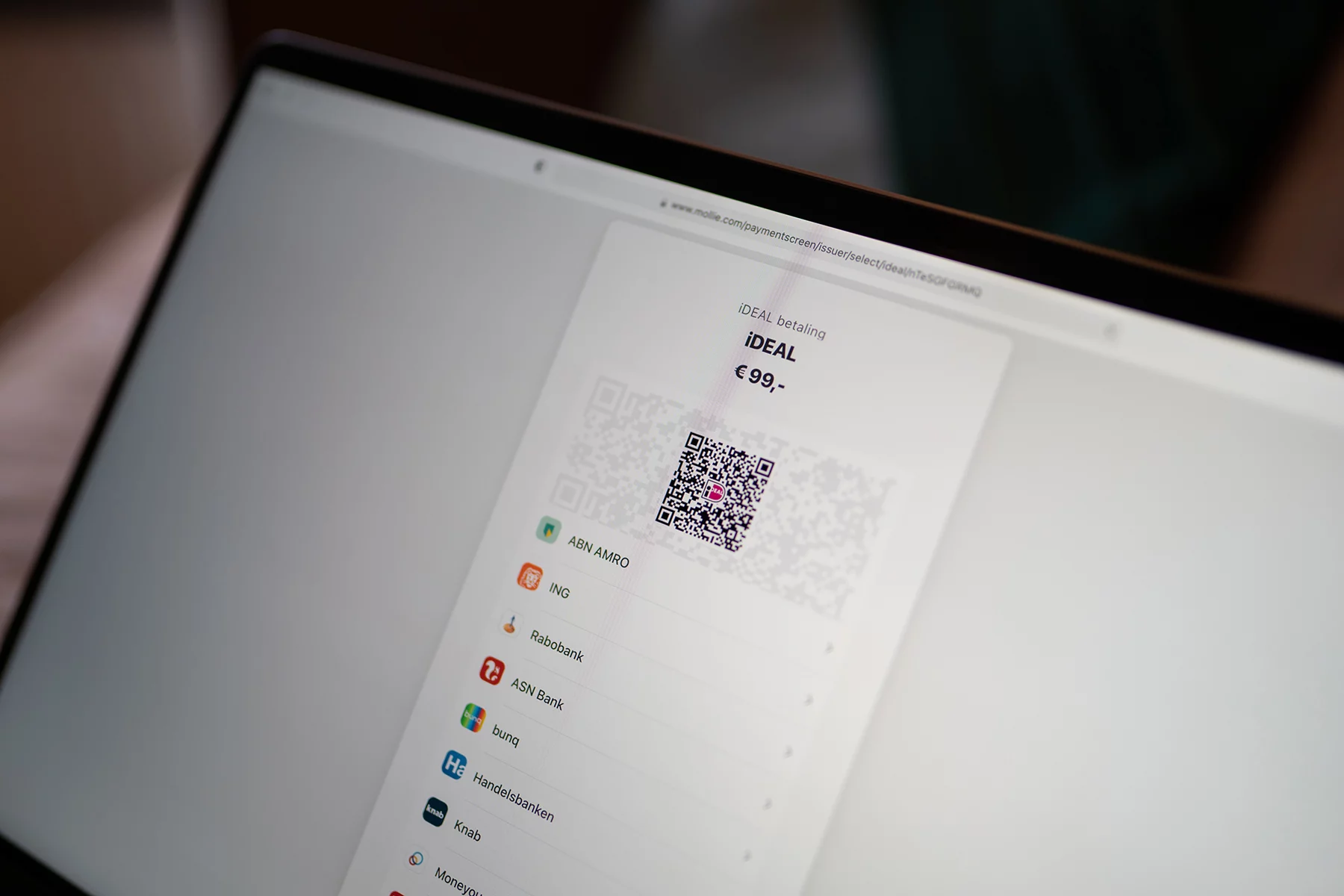

Mobile payments are financial transactions that are conducted through a mobile phone or other mobile device. These are an alternative to cash, credit cards, and other forms of payment. Mobile payments in the Netherlands are done using mobile apps or mobile wallets linked to bank accounts and installed on smartphones. Technology such as QR codes and near-field communication (NFC) enables people to make contactless payments in stores, pay for bills, or make immediate payments to friends.

Mobile payment apps in the Netherlands are available for both Apple and Android phones. The most popular is the iDEAL app. The Dutch online payments specialist has a 57% share of the e-commerce market in the Netherlands, with over half of its payments made through mobile banking. Other popular apps providers of mobile payments in the Netherlands include OK (which was developed by the team behind iDEAL), Payconiq, and PayPal. Individual Dutch banks generally have their own apps, as well.

Security for mobile banking

There have been consumer fears across Europe concerning mobile banking and mobile payments. However, doing banking through mobile devices is actually a safer way to bank and manage finances. Payment systems frequently use biometric data, such as fingerprint identification or voice activation; these are more secure than a PIN or signature. Additionally, payment systems and mobile banking in the Netherlands are heavily encrypted, so there is no compromise to security levels.

You can protect your finances against fraud and security breaches by taking measures such as:

- keeping everything password protected where necessary and using a high-strength password;

- never logging into your account using a public network or shared Wi-Fi;

- never keeping yourself logged into your account when it’s not in use.

Opening a bank account in the Netherlands

To open up a bank account in the Netherlands, you must provide valid ID, your residence permit, BSN (burgerservicenummer), and proof of address. Evidence of income is also necessary for certain accounts.

If you’re moving to the Netherlands and want to open an account before moving, you can open a mobile account with an online-only bank such as bunq, or N26. The process takes just minutes and you’ll be able to access your account from anywhere.

See our guide to opening a Dutch bank account for further details of the banking process in the Netherlands.