A GBP account can be useful if you’re paid in pounds, need to support family in the UK, or want to hold GBP alongside euros.

Dutch banks and international providers offer different solutions, from simple foreign currency accounts to multi-currency accounts with linked debit cards.

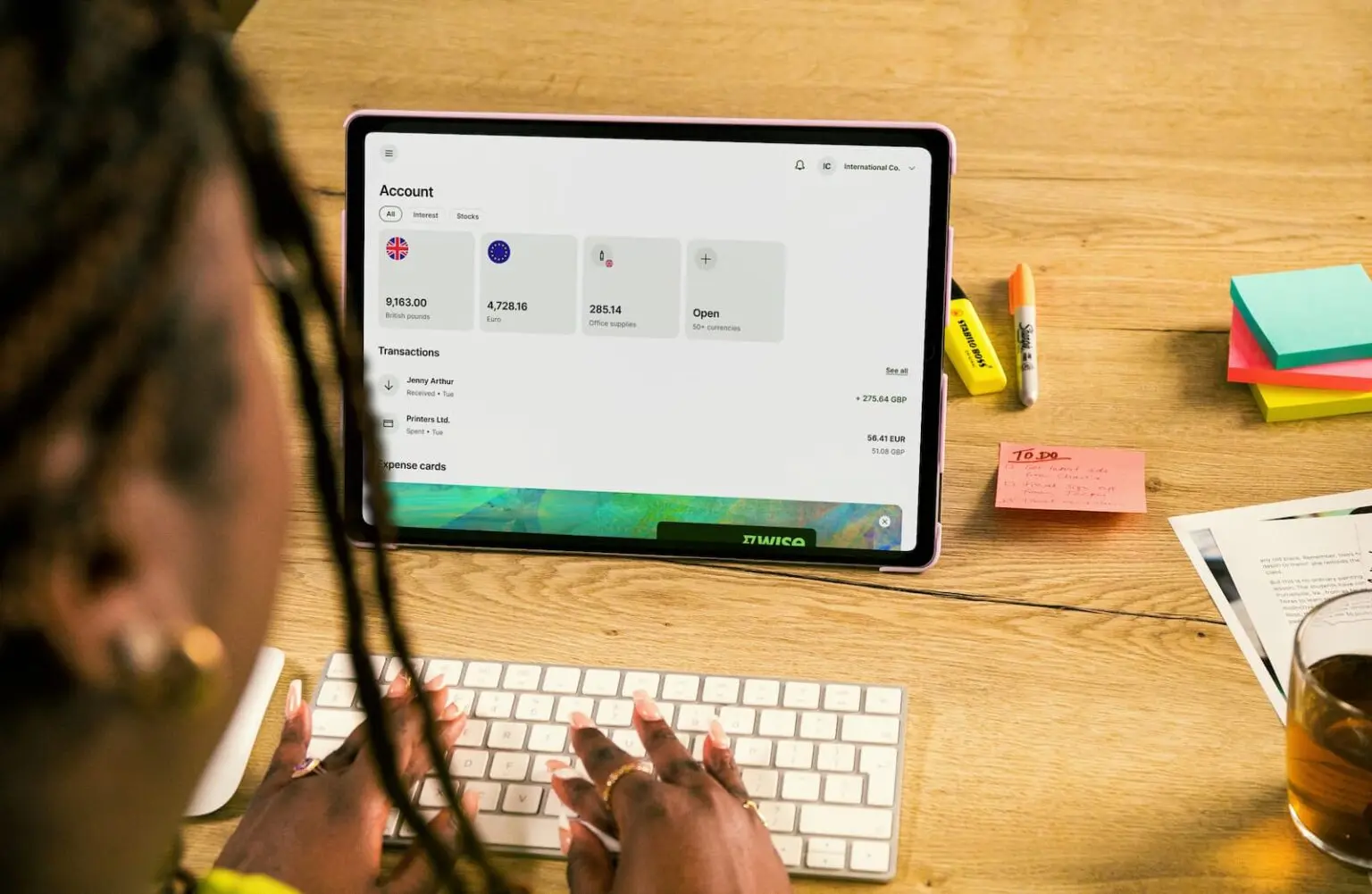

Wise, for example, provides GBP account details as well as the option to hold and exchange dozens of other currencies at the real mid-market rate. The best choice depends on how you intend to use the account, from everyday purchases to larger international transfers.

What is a GBP currency account?

A GBP currency account is a bank or online account that lets you hold money in British pounds while living in the Netherlands. Instead of converting every payment into euros, you can keep funds in pounds until you need them, or switch between currencies when it suits you.

Some accounts support only GBP, while multi-currency accounts also let you to hold euros and other major currencies in the same place.

Get a Wise Account

Open a Wise account to manage your pounds and euros side by side. You’ll get local GBP account details, making it easy to receive payments as if you had a bank account in the UK. Balances can be held in over 40 currencies, and conversions always use the mid-market exchange rate with no hidden markups. The Wise card adds extra flexibility, letting you spend directly from your account in 150+ countries or withdraw cash at ATMs.

Table of contents

- What is a GBP currency account?

- What can you do with a GBP account in the Netherlands?

- Types of GBP accounts

- Best GBP currency accounts in the Netherlands

- Wise account

- Revolut account

- ING Foreign Currency account

- ABN AMRO Foreign Currency Account

- Airwallex GBP Account

- Fees for GBP accounts in the Netherlands

- How to open a GBP account in the Netherlands

- How to use your GBP account in the Netherlands

- Conclusion

- Useful resources

What can you do with a GBP account in the Netherlands?

Having a GBP account gives you more control over how you manage money across two currencies. Instead of watching pounds turn into euros automatically, you decide when and how to use your balance, making daily life and international payments much easier to handle.

Here are some of the ways expats in the Netherlands often use these accounts:

- Receive payments from the UK: Get paid in pounds without automatic conversion to euros. Wise, for example, gives you UK account details so clients or family can send money as if it were a local transfer.

- Hold pounds for future use: Keep GBP in your account until the exchange rate is more favourable, rather than converting immediately at bank rates.

- Spend while travelling: Use a linked debit card, like the Wise card, to pay in pounds when you visit the UK and avoid extra foreign transaction fees.

- Pay UK expenses from abroad: Cover bills, mortgages, or subscriptions in the UK directly from your GBP balance.

- Move money between currencies with ease: With multi-currency providers, you can switch between GBP, euros and other currencies from the same account whenever you need.

Types of GBP accounts

Multi currency accounts: Multi-currency accounts let you hold GBP alongside other currencies in a single account. They usually come with extra features such as local account details, easy exchanges between currencies and linked debit cards.

- Wise: Hold and exchange 40+ currencies with local account details in GBP, EUR and more.

- Revolut: Manage 30+ currencies in one app with fast exchange options and a linked card for spending.

- Airwallex: Global account with GBP account details for receiving payments. Aimed at businesses, but useful for anyone needing to manage payments across multiple currencies.

Foreign currency accounts: Foreign currency accounts typically focus on one currency and let you hold GBP separately from your euro balance and convert it when you choose.

- ABN AMRO: The Foreign Currency Account lets you receive, hold and manage GBP or another supported currency, with flexibility to decide when to convert back to euros.

- ING: Offers a Foreign Currency Account for business customers to send and receive payments in currencies like GBP without immediate conversion.

Many of these accounts also come with debit cards to make spending easier.

Best GBP currency accounts in the Netherlands

Opening a GBP account in the Netherlands can be done through a local bank or with a specialist online provider. Banks like ING and ABN AMRO offer foreign currency accounts that let you hold pounds separately from your euro balance, giving you more control over when you exchange. Online providers such as Wise, Revolut and Airwallex focus on multi-currency accounts with extra flexibility, transparent pricing and features like debit cards or business integrations.

The “best” account depends on your priorities. Some expats want to save on conversion fees when being paid in pounds, others prefer accounts that let them move easily between multiple currencies, and business users often need global account details to collect payments abroad. To help compare, we’ve included providers that support GBP, are accessible to customers in the Netherlands, and stand out for convenience, pricing and ease of use.

| 💡 At a glance | |

|---|---|

| Wise | Multi-currency account with GBP account details, mid-market exchange rates and a debit card for global spending. |

| Revolut | Choose from 4 account tiers, hold and exchange 30+ currencies, including GBP and EUR, and spend worldwide with the Revolut debit card. |

| Airwallex | Business-focused global account with GBP bank details and interbank exchange rates. |

| ABN AMRO | Foreign Currency Account for personal clients, available in 27 currencies including GBP, at 5 EUR per month |

| ING | Business Foreign Currency Account available in 25 currencies, including GBP, with a monthly fee of 6 EUR |

Wise account

Wise gives expats in the Netherlands the chance to hold GBP alongside more than 40 other currencies in one account, convert at the mid-market exchange rate and receive pounds with local account details as if you had a UK bank account.

The account also links to a debit card, so you can spend in 150+ countries or withdraw directly from your balances, without expensive foreign transaction fees. You get 200 per month EUR (up to two withdrawals) free of charge at ATMs, after which a small fee applies.

- Hold and exchange GBP with 40+ other currencies, with conversion fees starting from 0.47%

- Receive GBP and other major currencies with local account details

- Spend or withdraw worldwide with the Wise debit card, linked directly to your balances

Account opening fee: None for personal accounts. Business accounts pay a one-time 60 EUR to unlock full features

Eligibility criteria: Available to residents in the Netherlands and most countries worldwide

Supported currencies: 40+ including GBP, EUR and USD

Monthly fees: None

Exchange rates: The mid-market rate

Revolut account

Revolut is used by more than 1 million people in the Netherlands and has become a go-to option for those who want flexibility with their money. You can hold GBP alongside over 30 other currencies and send transfers to more than 160 countries.

The account also includes a debit card that lets you spend like a local in 150+ currencies, whether you’re shopping online, travelling, or paying bills abroad. Different plan tiers are available, starting with a free Standard account and scaling up to Premium, Metal and Ultra, which add higher allowances and extras such as insurance or lounge access.

- Hold and exchange GBP, EUR and 30+ other currencies in one app

- Spend like a local in 150+ currencies with the Revolut debit card

- Send transfers to over 160 countries with transparent fees

Account opening fee: None for standard personal accounts

Eligibility criteria: Available to residents in the Netherlands aged 18+ with valid ID

Supported currencies: 30+ including GBP, EUR and USD

Monthly fees: Free for Standard. Paid plans start at 3.99 EUR and go up to 50 EUR depending on features

Exchange rates: Revolut’s own rates on weekdays up to your plan’s allowance; 0.5%–1% fee applies on extra amounts or weekend exchanges

ING Foreign Currency account

ING offers a Foreign Currency Account that lets you hold and receive GBP directly, which can be useful if you regularly deal with payments from the UK. The account is linked to your main ING Business account and allows you to make and receive payments in GBP without automatic conversion to euros. This way, you decide when to convert, helping you save on exchange rate markups and giving you more control over your money.

The account is available in 25 different currencies, including GBP, and shows up in your online banking or mobile app within a few days of opening.

- Receive and pay directly in GBP without automatic conversion to EUR

- Choose from 25 supported currencies, linked to your main ING Business account

- Manage balances easily in the ING online banking platform and mobile app

Account opening fee: None

Eligibility criteria: Available to ING business account holders in the Netherlands

Supported currencies: 25 including GBP and EUR

Monthly fees: 6 EUR per month

Exchange rates: ING applies a 0.85% markup when converting GBP and other non-euro currencies into EUR

ABN AMRO Foreign Currency Account

ABN AMRO provides a personal Foreign Currency Account for holding and managing GBP alongside 26 other currencies. It’s designed for private clients who often make or receive payments in foreign currencies, helping avoid unnecessary conversion costs.

Payments are always made and received in the currency of the account, so if you hold GBP, incoming transfers stay in pounds until you decide to exchange, and currency conversion is available through Monday to Friday. Deposits are protected under the Dutch Deposit Guarantee Scheme up to 100,000 EUR, giving extra peace of mind.

- Hold and receive payments in GBP and 26 other currencies

- Avoid automatic conversions by managing foreign currency balances directly

- Convert up to 5 million EUR per currency conversion.

Account opening fee: None

Eligibility criteria: Available to personal customers with an ABN AMRO current account in the Netherlands

Supported currencies: 27 including GBP, EUR and USD

Monthly fees: 5 EUR per month

Exchange rates: ABN AMRO applies its own exchange rates, which includes a markup.

Airwallex GBP Account

Open a global business account to open and use a local GBP account online with in the Netherlands. You’ll receive UK bank details, making it easy to get paid in pounds without unnecessary conversion fees.

The platform also supports 20+ currencies with local accounts, and balances can be converted at interbank rates whenever you choose. Airwallex integrates with tools like Xero, and corporate cards are available to spend in multiple currencies without international fees, making it a convenient choice for internationally active businesses.

- Open a GBP account online with local UK bank details

- Hold and manage 20+ currencies, converting at interbank rates

- Spend worldwide with Airwallex corporate cards, without extra FX fees

Account opening fee: None

Eligibility criteria: Available to registered businesses in the Netherlands

Supported currencies: 20+ including GBP and EUR

Monthly fees: Free on the Explore plan (or 19 EUR if minimum balance/transactions not met). Grow plans start from 49 EUR per month and go up to 999 EUR on the Accelerate tier

Exchange rates: Interbank rate

Fees for GBP accounts in the Netherlands

The cost of holding a GBP account in the Netherlands depends on whether you go with a traditional bank or a digital provider. Some fees are fixed, while others vary based on how much you transact, the plan you choose, or the type of transfer.

- Account opening fee: Most personal accounts with providers like Wise and Revolut have no setup cost, while some business-focused services may add a one-time charge.

- Monthly maintenance fee: Banks such as ING and ABN AMRO apply a small monthly fee (around 5-6 EUR). Digital providers like Wise don’t charge ongoing account fees for personal use.

- Currency conversion fee: Wise applies transparent fees from 0.47% using the mid-market rate, while banks like ING typically add a 0.85% markup when converting GBP into euros.

- ATM withdrawal fee: Revolut and Wise both allow free withdrawals up to a set monthly allowance of 200 EUR, after which small fees apply.

- Foreign transaction fee: Spending abroad with a bank-issued card often comes with extra costs. With digital providers, these are typically waived or replaced with a clear exchange fee.

- Wire or transfer fee: SWIFT transfers can involve higher charges and intermediary costs. Providers like Airwallex and Wise usually keep these lower and show the costs upfront.

How to open a GBP account in the Netherlands

Opening a GBP account in the Netherlands is usually a simple process, but the steps vary depending on whether you go with a Dutch bank or an international online provider.

In most cases, you’ll need proof of identity, proof of address and a BSN (citizen service number), which banks are required by law to have. Once approved, your account is linked to online or mobile banking so you can start using it right away.

With banks:

Most of the time, Dutch banks like ING and ABN AMRO require you to already hold a euro-denominated current account before adding a foreign currency account. Depending on your chosen bank, you might need to book an appointment in your local branch or apply online before submitting valid ID and other required documents.

Accounts are opened in your name and usually activated within a few working days. Fees apply on a monthly basis, and conversion charges are added whenever you switch between pounds and euros.

With online providers:

Specialist platforms such as Wise, Revolut and Airwallex let you set up a GBP account digitally, often within minutes. You’ll be asked to verify your identity by uploading documents and, if needed, confirming your address.

Once verified, you’ll receive local account details for GBP and can start receiving payments just like you would with a UK bank account. For personal customers, there are usually no opening or maintenance fees, unless you’re on a tiered plan, while business users may face a small one-off charge depending on the provider.

How to use your GBP account in the Netherlands

A GBP account in the Netherlands can make daily life easier for expats and international professionals. From managing income to spending abroad, these accounts give you more flexibility in how you handle your money.

- Receive payments from the UK: Share your GBP account details with employers or clients and get paid as if you had a local UK bank account. Wise, for example, provides local account numbers that make receiving pounds fee-free (except for SWIFT transfers).

- Send money internationally: Transfer GBP directly to friends, family, or suppliers in the UK without automatic conversion to euros. Wise also provides transfers to over 160 countries at the mid-market exchange rate.

- Hold and exchange currencies: Keep your balance in GBP until you choose to convert. With Wise and Revolut, you can switch to euros or other currencies when the timing works best for you.

- Spend abroad with a card: Wise and Revolut link their accounts to debit cards, so you can pay in GBP, euros, or more than 150 other currencies without hidden foreign transaction charges.

- Withdraw cash when needed: Use your card to take money out at ATMs in the Netherlands or abroad. With Wise, the first 200 EUR per month is free, making access to your balance more affordable.

- Manage business income and expenses: Services such as Airwallex and ING provide business GBP accounts with additional features, like the ability to invoice in pounds and pay international suppliers without unnecessary conversions.

Conclusion

Managing pounds from the Netherlands can look very different depending on the account you choose. Some people prefer the security of a Dutch bank like ING or ABN AMRO, while others value the flexibility of digital providers such as Wise or Revolut for keeping costs low and currencies easy to handle. What matters most is finding the account that matches how you actually use your money, like receiving payments or spending abroad and holding savings in GBP.

For those who want clarity and convenience, Wise is a convenient everyday financial companion. You know every fee before you send, can hold GBP alongside 40+ currencies and the linked debit card works in more than 150 countries.

Thinking about opening a GBP account? Start using Wise and keep more of your GBP when living in the Netherlands.

Useful resources

Wise: Multi-currency accounts with GBP and EUR, low conversion fees, and a linked debit card (checked September 2025.)

Revolut: App-based account supporting GBP and 30+ other currencies, with different plan tiers (checked September 2025.)

Airwallex: Business-focused global accounts with local GBP details and interbank exchange rates (checked September 2025.)

ING: Dutch bank offering foreign currency accounts, including GBP, for business customers (checked September 2025.)

ABN AMRO: Personal foreign currency accounts available in GBP and other currencies (checked September 2025.)

Dutch Deposit Guarantee Scheme: Official information on deposit protection in the Netherlands, covering up to 100,000 EUR per person per bank (checked September 2025.)